- The Connection Between Accounting Methodologies and Duty Drawback

- Five Drawback Accounting Methods

- Showing the Impact: Real World Scenarios

- Low-to-High: Cosmetics Industry Scenario

- Last-in, First-Out: Auto Parts Industry Scenario

- Read This Before Switching Methodologies

- Which Drawback Method Fits Your Needs

- Q&A

- Let CITTA Maximize Your Drawback Returns

If your business is eligible for duty drawback, selecting the right accounting methodology could be the difference between a modest refund and a financial windfall. Whether you’re in cosmetics, auto parts, apparel, or another industry impacted by recent increases in U.S tariffs, your methodology is key.

This guide will help you understand the methodologies approved by U.S. Customs and Border Protection (CBP) and how to select the right one for your operation. Given the importance of making the right selection, we recommend working with a customs brokerage or service provider that specializes in duty drawback to maximize effectiveness and ensure compliance.

The Connection Between Accounting Methodologies and Duty Drawback

From the perspective of CBP, claimants, and drawback providers, your accounting methodology determines how drawback claims are calculated and validated. It can impact:

- are matched to prior imports or exports

- (harmonized tariff code) classifications are tracked across time

- or slowly your inventory bank gets depleted

Because businesses are subject to changing HTS classifications or a shifting ratio of domestic to international sales, the choice of methodology can significantly affect your refund potential and compliance posture.

Moreover, you must declare your selected methodology when submitting a privileges application—a prerequisite to claiming drawback. Switching methodologies later comes with rules: you must have used your current method for at least a year, and you’ll need to restart your import bank from a new point in time.

Five Drawback Accounting Methods

According to § 191.14 section C, there are five approved accounting methods for use in the identification of merchandise or articles for drawback purposes:

- Specific Identification

- FIFO (First In, First Out)

- LIFO (Last In, First Out)

- Low-to-High

- High-to-Low

Showing the Impact: Real World Scenarios

In serving hundreds of businesses over the years, the most common methodologies we advise clients to use are the Low-to-High, FIFO, or LIFO. Here are some examples of how these methodologies can impact drawback returns over time.

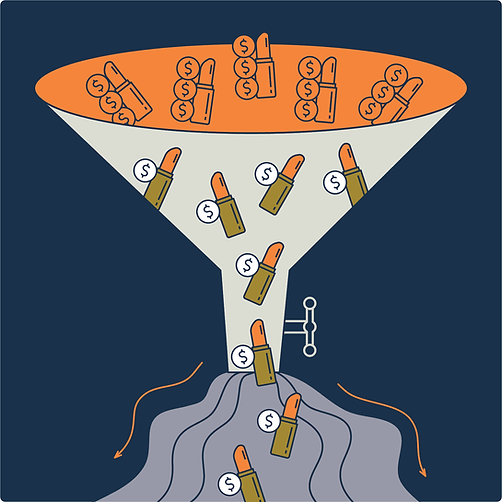

Low-to-High: Cosmetics Industry Scenario

Let’s say you import lipsticks—red, pink, and orange. You’re exporting only 5% of your inventory and selling the rest domestically. Under the Low-to-High methodology, CBP looks back five years and matches your exports to the lowest duty-paid imports first.

If your 2020 imports came in at a 25% duty rate, and today’s rates are 35%, the Low-to-High methodology will prioritize drawing from those older, “cheaper” imports—even if they’re slowly aging out of eligibility due to the five-year statute of limitations.

The downside? If you’re not exporting much, it might take years before you ever tap into higher-rate imports, if ever.

In this scenario, a beauty brand is using the Low-to-High methodology to match their exports to lipsticks that were imported at a time when the tariffs were lower than the more recently imported lipsticks.

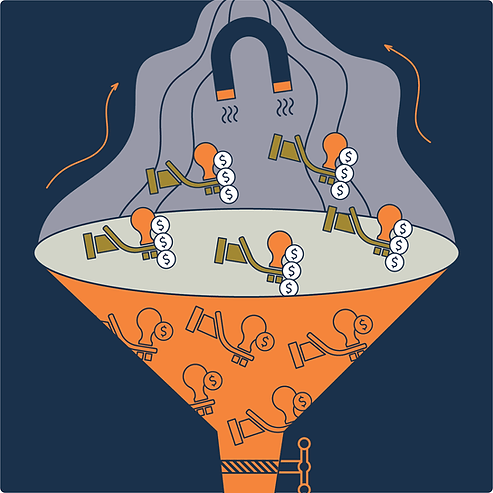

Last-in, First-Out: Auto Parts Industry Scenario

Imagine you’re a supplier of vehicle hitches, exporting 80% of your inventory. In 2018, when the Section 301 tariffs hit, a CITTA client in this exact situation chose the Last-in, First-Out methodology to maximize their claim so the most recent imports—those with the highest duties—could be used up first, accelerating the drawdown of higher-value refund opportunities.

Unlike Low-to-High, Last-in, First-Out requires accounting for both exports and domestic sales. It mirrors your actual inventory flow more closely, but adds complexity, especially if you aren’t tracking domestic sales at the SKU or color level (e.g., red lipstick vs. pink).

In this scenario, an auto parts importer is using the Last-in, First-out methodology to match their exports to trailer hitches that were imported at a higher duty rate than those imported a few years earlier.

Read This Before Switching Methodologies

Remember, switching methodologies after you’ve filed a privileges application requires that you must have used your current method for at least a year. And, you’ll need to restart your import bank from a new point in time. If you’re considering a switch, we recommend these steps.

- your drawback provider. The current dynamic tariff environment has caused businesses and customs brokers to pivot in a variety of ways. If your current drawback provider hasn’t proactively reached out regarding your methodology yet, that might indicate that they’re not prioritizing drawback like they should.

- code trends and your ACE reports to ensure clean classification across brokers. Inconsistencies here can make it difficult to match imports and exports.

- abandon your existing inventory bank and start fresh. This is especially important if your tariffs have increased significantly or if you’ve recently started paying import duties on goods that you originally imported duty-free.

Which Drawback Method Fits Your Needs

If your product lines are highly variable (e.g., clothing or cosmetics with SKUs by color/size), the Low-to-High accounting methodology may be easier because it doesn’t require tracking every domestic sale.

But if you already track domestic sales in detail, LIFO or FIFO might yield better results and more realistic inventory alignment.

Q&A: What Businesses Ask Before Filing Their Claim

Since the introduction of higher tariffs earlier this year, we’ve fielded dozens of questions related to accounting methodologies. Here are a few of the more common questions we’ve received.

LIFO/FIFO requires granular data on domestic sales; Low-to-High generally does not.

No. The methodologies discussed here apply to drawback claim calculations, not financial inventory systems. Don’t confuse the two.

Start with your drawback provider. Use data (e.g., HTS classifications, duty rate shifts) to justify the change and align stakeholders across finance, operations, and compliance teams.

Let CITTA Maximize Your Drawback Returns

The right methodology can be the difference in a modest drawback return or a significant opportunity to reinvest into your business and retain your competitive edge. Choosing the wrong one, delaying a switch, or doing nothing at all could result in leaving money on the table.

We get it. Making a change—or even looking under the hood once—can seem scary. Let us take on that burden by setting up a discovery call with a CITTA drawback consultant today. We’ll review your current methodology, assess your HTS history, and help you chart the best path forward.