Customs Duty Defined: Your Guide to Optimizing International Trade Operations

How Tariffs Affect Businesses: A Strategic Guide

Why You Should Re-Evaluate Your Duty Drawback Program Now

Privileges Applications: Your Gateway to Drawback Recovery

How to Maximize Duty Drawback Recovery: A Systematic Guide for Importers

Compliance Audits: The Foundation of a Successful Duty Drawback Program

Types of Duty Drawback: A Strategic Guide for Business Leaders

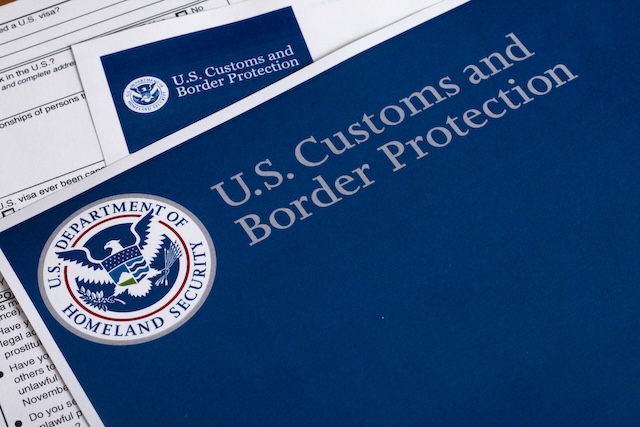

CBP Drawback Guidance: What to Know About Maximizing Your Recovery Potential