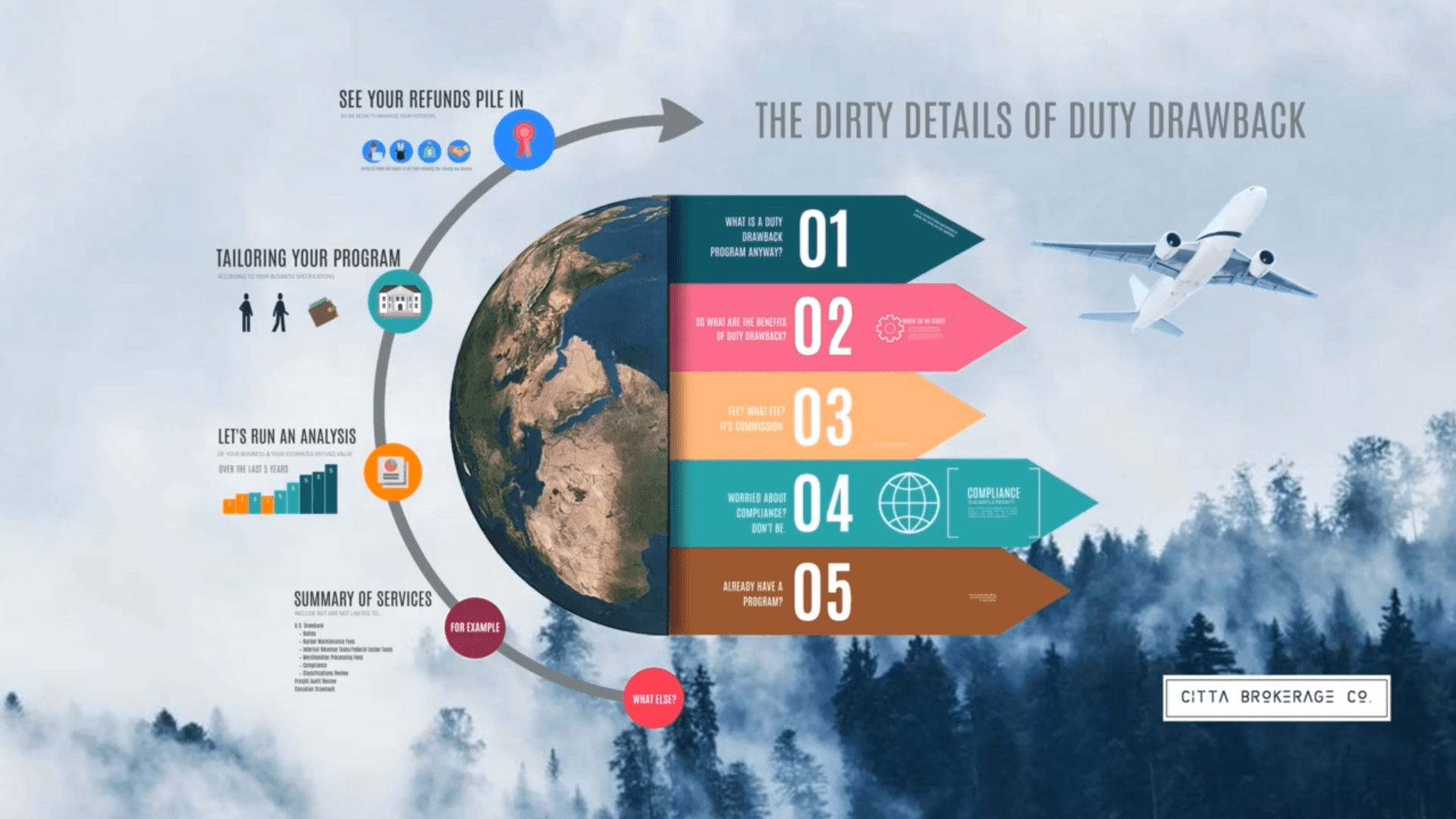

We know duty drawback can seem overwhelming, with mountains of paperwork and expiring shipments. And of course, each industry has different export processes and needs, so you need to find what works best for your organization.

As drawback experts, we do the heavy lifting to establish your duty drawback program, file your claims, and ensure you get reimbursed as quickly as possible. We’ll not only tell you which documents you need; we’ll also tell you where to find them or who to collaborate with to minimize your workload throughout the process. Then, we file your claims and ensure the U.S. Customs agency has everything they need to approve each refund.

Our expertise allows you to move forward with confidence that your drawback program is compliant, maintaining the relationship between you and Customs so you don’t have to worry.