As the global trade landscape braces for another round of uncertainty, July 9, 2025—President Trump’s original deadline for countries to negotiate rates for his “Liberation Day” (a.k.a., reciprocal) tariffs—has come and gone. With the tariff deadline now extended to August 1, businesses are watching closely to see if the White House amends or intensifies these sweeping levies on imported goods.

Early signals suggest that the current administration may double down on existing tariffs, particularly on imports from China and other strategic regions. As importers and exporters alike brace for impact, many are already taking action. According to a recent KeyBank Pulse Survey:

-

91% of companies are focused on managing tariff impacts as a top priority

-

53% are passing costs to customers and 47% to vendors

-

60% of companies are adjusting their supply chain strategies to manage tariff costs

Among the strategies available for mitigating the impact of tariffs, many companies are turning to duty drawback—a method of recovering tariff-imposed duties, taxes, and fees paid on imported goods that subsequently leave the U.S. or are destroyed. Drawback isn’t available for all tariffs, however. In this blog post, I’ll explain:

-

Which tariffs and fees qualify for drawback

-

Which ones are explicitly excluded

-

The status of the Liberation Day tariffs

-

The timeline for international negotiations

-

And the legal battles that might impact tariffs

Which Types of Tariffs, Taxes, and Fees Are Eligible for Drawback?

Duty drawback allows companies to recover up to 99% of certain duties, taxes, and fees paid on imported goods that are later exported or destroyed. The following are currently eligible for refunds:

-

Ordinary customs duties, including voluntary tenders and marking duties

-

Section 301 tariffs, including duties specifically targeting China

-

Section 201 safeguard tariffs, such as those on solar cells and washing machines

-

Reciprocal tariffs, also known as Liberation Day tariffs, including new ad valorem duties up to 50%

-

Internal Revenue taxes, including excise duties on alcohol, tobacco, and petroleum

-

Duties under 19 USC 1592(d), such as those disclosed through prior disclosures or penalties

If your business imports and later exports or destroys goods that fall under these categories, you may be eligible for significant refunds. Here’s a short video to help you know whether your organization qualifies.

Which Tariffs and Fees Are Excluded from Drawback?

Not all duties qualify. The following are specifically excluded from drawback eligibility:

-

Section 232 tariffs on metals such as aluminum and steel, as well as automobiles

-

Certain IEEPA-based duties, including those targeting fentanyl precursors and autos

-

De Minimis duties and fees on low-value imports (exclusions began in May 2025)

Even though these exclusions may seem narrow, they can significantly affect businesses in high-tariff categories.

Status of the Reciprocal (Liberation Day) Tariffs

Despite ongoing legal and political challenges, the reciprocal tariffs remain in effect. These duties, introduced to equalize trade imbalances, were paused for many countries to allow for negotiations—but only temporarily:

-

The 90-day pause began in early April 2025

-

Most country-specific tariffs are paused until August 1st, 2025

-

Tariffs on China and Hong Kong remain active and at elevated levels

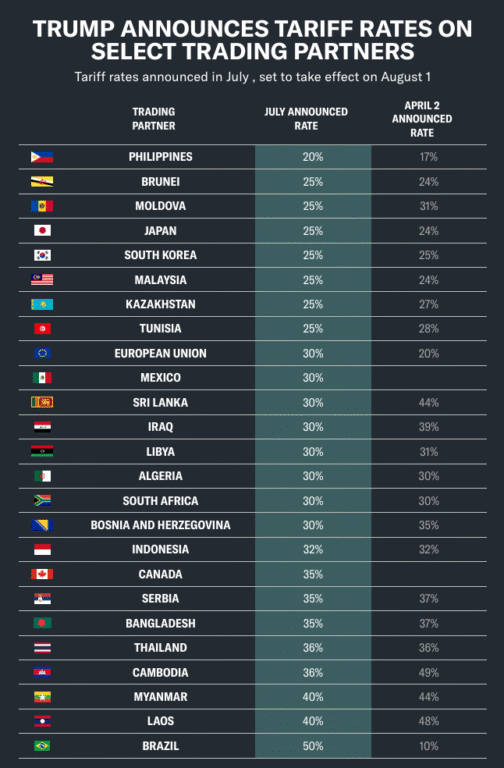

The August 1 tariff deadline is critical. If no agreement is reached by then, reciprocal tariffs could be go into effect at the rate President Trump recently outlined in letters sent to the affected countries. These rates include:

Source, Yahoo Finance.

Legal Actions That Could Reshape Tariff Policy

Several legal challenges are underway that could affect the future of the Liberation Day tariffs and their implementation:

-

In V.O.S. Selections v. United States, a federal court ruled that the reciprocal tariffs are unconstitutional under the International Emergency Economic Powers Act (IEEPA). However, that ruling is on hold pending appeal, with oral arguments scheduled for July 31, 2025.

-

In a separate case in Washington, D.C., a limited injunction was granted against enforcement.

-

A California lawsuit was dismissed on procedural grounds but is expected to be appealed to the 9th Circuit.

-

The U.S. Supreme Court declined to expedite its review of the issue, but may still weigh in at a later date.

If the courts ultimately strike down these tariffs, businesses may be eligible for retroactive refunds, and the regulatory framework could shift dramatically.

Conclusion

With tariff policy in flux and a firm negotiation deadline approaching, now is the time for businesses to take stock. Understanding which tariffs are eligible for drawback and which are not is key to maximizing recovery and managing risk. As the August 1st tariff deadline nears, staying informed about ongoing legal battles and international negotiations is essential. Whether tariffs are extended, modified, or overturned, proactive planning will help businesses adapt to whatever comes next.

Ready to discover which tariffs are eligible for drawback? Let’s have a conversation about your specific situation. Set up a discovery call today.