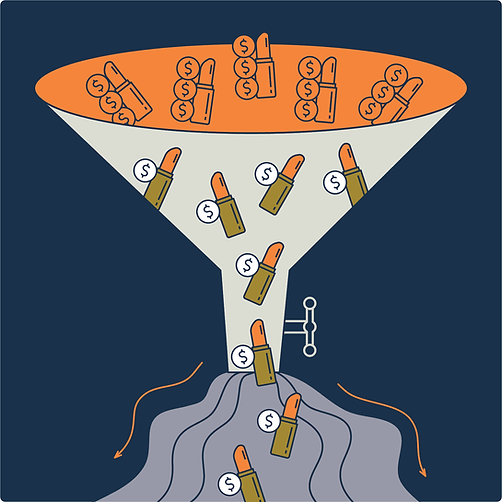

Countless organizations leave millions in duty recoveries unclaimed. If you haven't evaluated your duty drawback strategy recently—or haven't...

The tariff landscape has fundamentally shifted. With duty-free imports becoming increasingly rare, U.S. companies are now facing substantial duty...

Most companies are walking away from millions in duty drawback recovery without even knowing it. The numbers tell a shocking story: firms pay massive...

When it comes to duty drawback, compliance is more than a requirement—it’s the key to protecting refunds and safeguarding business operations. A...

After nearly a decade of helping companies navigate international trade complexities, the evidence is clear: duty drawback programs can really...

Throughout my experience helping businesses navigate U.S. Customs and Border Protection regulations, I’ve seen countless companies leave millions...

As the global trade landscape braces for another round of uncertainty, July 9, 2025—President Trump’s original deadline for countries to...

If your business is eligible for duty drawback, selecting the right accounting methodology could be the difference between a modest refund and a...

With the Trump Administration's focus on import tariffs, businesses are once again feeling the pressure of rising trade costs. As these levies...